In the last two months, thanks to heavy rains, the months of power outages of several hours seem to have been forgotten and no one seems to be doing much to even talk about what to prepare for once the rains stop for us. The last couple of days has seen that reality creeping up on us and the power cuts have already increased to over two hours in most areas. Obviously much more hours of cuts will be on the cards sooner than later.

The Minister of Energy has predicted in his parliamentary meeting (www.fb.com/apemedia.lk) that there will be a power cut for 7-8 hours before October 15, and the Minister has clearly explained the omissions in the purchase of coal. This reality is already with us with the refinery grinding to a halt for lack of FOREX for the crude oil and the ongoing arguments on the mode of import of coal, even if funds are found most probably with a further loan. Continuation of operation of the coal power plant will continue to add to the already unsustainable debt burden without any let up.

The abyss facing us in a few short months

With the usual amnesia Sri Lankans would have already forgotten the miles long fuel queues only a few months back. Many would not have realized that this was due to the manipulations of the interested parties to continue the disastrous practice of using oil based emergency power to bridge the deficit due to the reduced hydro generation every year in the January to April period.

More and more borrowings seems to be the only way out under the present circumstances. This is inevitable and has to be accepted reluctantly in the short term, as the disruption caused to the economy on one hand and the entire society, by the lack of fuels for transport during the January to April period, should not be ignored nor allowed to be repeated next year too.

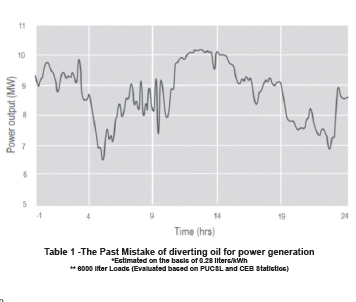

This was caused entirely due to the short sighted decisions to keep the duration of the power cuts down, by diverting near 75% of the available supplies of fuels and the funds, for power generation, with the grave detriment to the transport sector. Based on data on the share of oil based power generation, provided by the PUCSL and estimated of the quantity of oil consumed during that period (Table 1).

Now with the uncertainty of full scale operation of the coal power plant, which is not felt too harshly at present due to the significant contribution by hydro power, the situation is bound to be even worse than in 2022, with further deterioration of the rupee as well as the avenues for further debts drying up. A repetition of the disruption to the transport sector in 2023, will completely disrupt any form of recovery of the economy including the tourist sector. As such any decisions made at present would have very far reaching impacts with very long term repercussions and thus must be made with much greater insights covering the national economy, rather than with mere consideration of the cost per unit or the particular sector coming forward to provide such energy coupled with the demands on the meager FOREX reserves that can be accessed.

The only way out

While it may be far too late to make a significant impact in the short time available, the only short term means of adding the gravely needed additional power generation capacity and the energy to the shortfall created by the lack of coal, and the inevitable drought months is by the rapid addition of the roof top solar PV systems. There is absolutely no other means or resource capable of doing so even in the next 12 months. But are we grabbing this opportunity with alacrity? The revision of the feed in tariff under the Surya Bala Sangramya, as far back as 2016, to reflect the current unfortunate and inescapable financial parameters currently prevailing have been long delayed. It is understood that the tariff committee has arrived at a feed in tariff level which could retain the interest of the investors and hopefully fast track the addition of as many installations as possible in the shortest possible time. It is believed that these tariff levels are much lower than the cost of coal power at present price levels and certainly less than half that would be needed to continue using any oil for power generation.

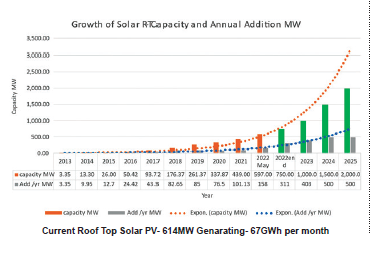

It must be recorded that before the axe fell by way of the devaluation of the rupee and the unbelievable rise on the interest rates, over 625 MW of roof top solar, providing over 800 GWh of energy annually were added to the system. However, no tariff has been announced yet. It is reliably understood that some parties are trying to offer totally unviable levels of tariff, completely ignoring the inescapable reality of the prevailing financial parameters, on a purely ad hoc basis. This along with the possibility of declared intention of scraping the two systems of Net Accounting and Net Plus schemes, which attracted the larger private sector entities to enter the industry, is tailor made to ensure we will face the projected 7 – 8 hour power cuts definitely in January when the draught season begins.

If Sri Lanka is to have any hope of minimizing, certainly not eliminating the long hours of power cuts, with the distinct possibility of happening inevitably by January, even if we are successful in getting enough coal at whatever prices, attempt must be made to add at least 500 MW of roof top solar in the next six months. This while seemingly a tough task, is still possible, with the relaxation of some regulations by the CEB permitting large roof spaces to be brought in and the corporates owning such roof areas being ready to invest, provided the feed in tariff is workable. The delay in announcing a viable feed in tariff for Solar Roof Tops have already eroded significantly the available time for this positive contribution. The performance of the sector illustrated in Figure 1 provides credibility for this confidence. It appears that the CEB is already planning to add the most expensive option of Emergency Power once more , which will not only be a huge burden on the economy ( as CEB expects the losses to be borne by the treasury as has happened in the past). There is the even greater danger of the repetition on the disastrous situation experienced in early 2022, if the meager supply of oil will be diverted for power generation, depriving the transport sector.

There are some other barriers such as the access to the necessary foreign exchange for the import of essential components and other issues to be settled with the CEB. But the most important starting point at which the private sector investors, with absolutely no burden on the beleaguered treasury, is the most urgent declaration of the viable feed in tariff to replace the now totally outdated tariff worked out in 2016 and continuation of the three systems under the Surya Bala Sangramya. The willing and committed assistance by all the officials of the CEB and LECO who must at least now place the interest of the country first and be ready to resolve any technical issues, which are very much in their capacity to do so, would make this goal that much easier.

The fact is that every MW of solar added helps to rid Sri Lanka of the burden and the dependence on imported coal and oil, for which now we have to go begging for the dollars. The value of this non dependence and the relief from the continuing burden of debt, cannot be assessed in Rupees or Dollars. We appreciate the speedy resolution of this tariff issue so that we can be on our way without dependence on imported fossil fuels.

Eng. Parakrama Jayasinghe

14th November 2022

40-13